TNGlobal Tracker: startup funding snapshot for October 2024

Editor’s notes: data provided by data platform Tracxn

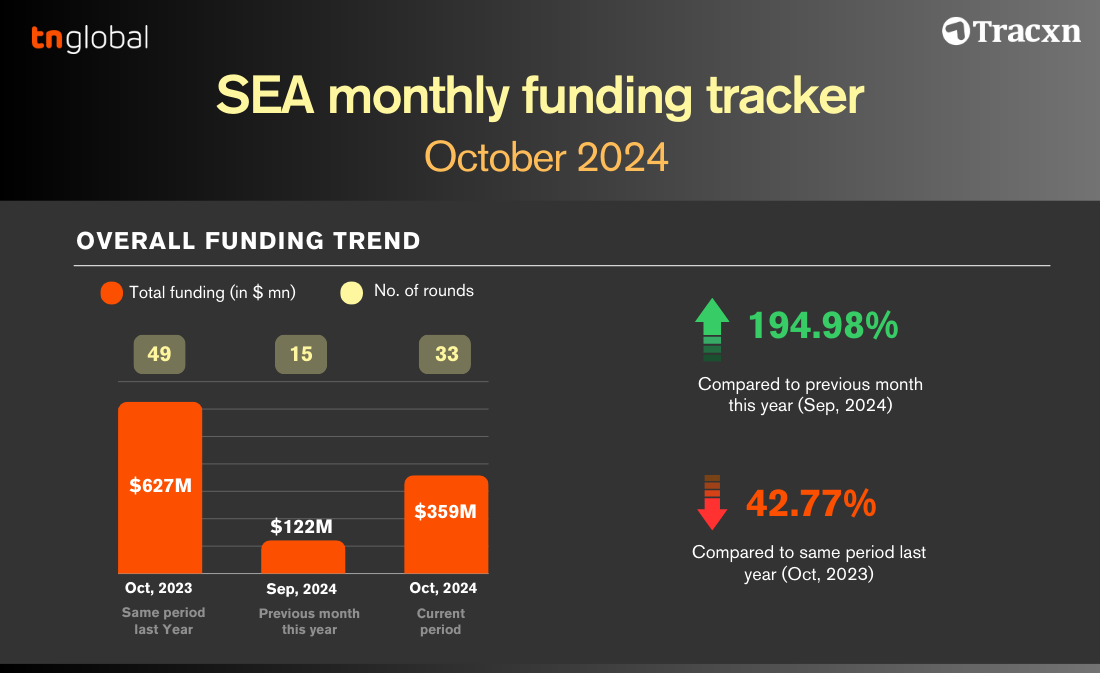

Startup funding in Southeast Asia saw a notable uptick in October 2024, with a total of $359 million raised across 33 rounds. This represents a 194 percent increase from September 2024, although the figure remains a striking 42 percent lower than the same month last year.

Dominance of Early-Stage Funding in October

● The funding landscape in October was dominated by late-stage investments, which accounted for the bulk of capital raised at $171.5 million, a significant decline from $288.8 million in October 2023. Early-stage investments also saw a boost, with $161 million raised, up from $106.2 million the previous month (September 2024). Seed-

stage funding stood at $26.2 million in October this year, a sharp contrast from $155.4 million in the same month last year.

Exit Activity Declines in October 2024

● Exit activity remained subdued, with only 1 IPO recorded, compared to 2 IPOs in October 2023. However, there were 3 acquisitions, down from 9 last year.

Top Funding Deals in October

● Among the standout deals, Emeritus led the pack with $150 million raised, followed by Salmon at a distant second with $30 million. Other notable rounds include Broom and Chickin, securing $25 million and $20 million, respectively.

City Wise Trends in October

● The funding was heavily concentrated in Singapore, which saw the largest share of capital at $242.5 million, followed by Jakarta at $32.5 million. Taguig also saw strong participation, raising $30 million.

Key Investors and Types of Funding

● Venture capital firms played a central role in funding, with notable investors like The Rise Fund, Khosla Ventures, and EDBI participating in key rounds. The private equity sector also saw activity, with firms like LeapFrog Investments and Tin Men backing companies like HealthifyMe and GlobalTix.

Despite the rise in funding compared to the previous month, the overall market remains down compared to last year, highlighting the ongoing cautious sentiment in the startup ecosystem.

The early-stage sector remains the most active, suggesting continued investor interest in emerging companies across the region.

Key Takeaways:

● $359 million raised in October 2024, a 194 percent surge from September but a 42 percent drop from last year.

● Late-stage funding dominated the market.

● Singapore remains the top destination for investment, followed by Jakarta and the Taguig.

● Exits remain limited, with only one IPO in October 2024.

The funding trend points to a recovery from September but continues to reflect broader market challenges, with investors particularly focused on early-stage opportunities.

![]()

#SoutheastAsiaStartups #VentureFunding #StartupEcosystem #EarlyStageInvestments #InvestorTrends #Ifvex

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- เกมส์

- Gardening

- Health

- หน้าแรก

- Literature

- Music

- Networking

- อื่นๆ

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness