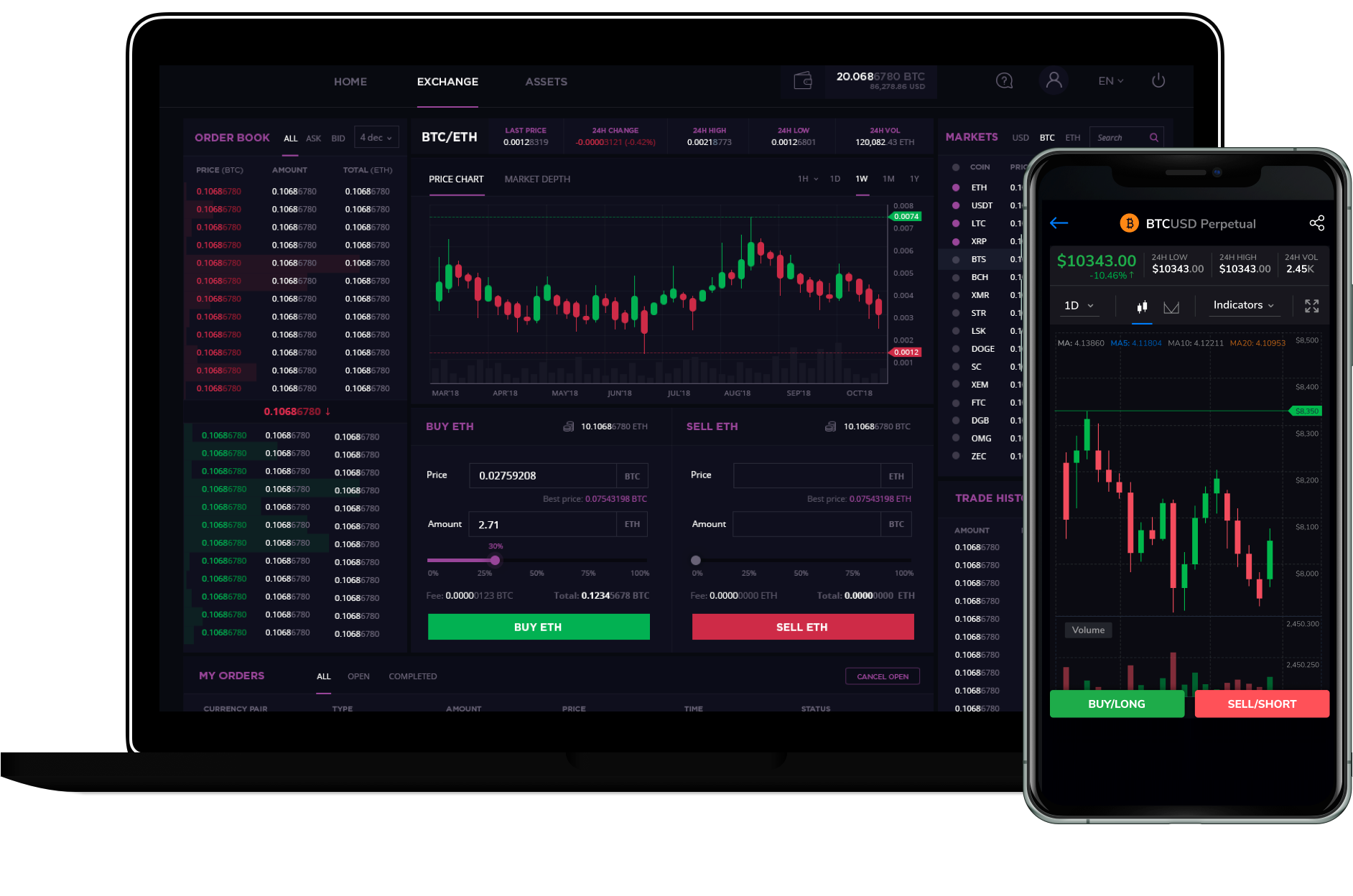

A Crypto Derivatives Exchange is a platform that allows traders to buy and sell cryptocurrency-based financial products, such as futures, options, and swaps. These products derive their value from underlying assets like Bitcoin, Ethereum, or other cryptocurrencies, enabling users to speculate on price movements without owning the actual crypto assets.

Sponsored

Search

Sponsored

Categories

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

Read More

"Visa Online: Simplifying Global Vacation for You"

"How exactly to Apply for Visa On the web: A Step-by-Step Guide"

In the current fast-paced...

Crispy Chicken Thighs with White Beans & Tomatoes

This recipe for crispy chicken thighs with white beans is an easy one pot meal that delivers on...

Introduction to rigid-flexible boards

Rigid-flex boards combine the properties of both flexible and rigid boards by integrating...

© 2024 Ifvex

English

English