Malaysia’s Hoopi closes seed funding round spearheaded by Creative Gorilla Capital

Hoopi Holdings Pte Ltd, a collectibles and trading cards platform based in Malaysia with Indonesia presence, has successfully secured its maiden institutional funding round led by Creative Gorilla Capital (CGC), a Jakarta-based venture capital firm that invests in early-stage consumer-facing businesses.

CGC said in a statement on Wednesday that the investment has enabled Hoopi to expand its platform’s user ecosystem and core services, facilitating strategic growth across the Southeast Asian region.

Since its official launch in September 2024, Hoopi has achieved impressive traction, generating nearly $2.25 million GMV through more than forty thousand paid orders as of February 2025.

The platform currently boasts over 20,000 active users and more than 3,000 registered sellers. Currently operational in Malaysia and Singapore, it is set to expand into Indonesia in April 2025 and Thailand later this year.

Hoopi’s Chief Executive Officer and Co-founder Michael underscored this progress, affirming that the investment from CGC has strengthened the core strategic pillars of Hoopi and supported the establishment of its growing presence in Malaysia, Singapore, and – imminently – Indonesia, marked by the upcoming launch of the Hoopi Store in Jakarta.

“Bolstered by an established supply and distribution network, a platform experiencing consistent gross merchandise value (GMV) growth, our soon-to-be-launched offline physical stores, and our proprietary in-house grading service, Grade Master, I am confident that Hoopi and its integrated ecosystem are uniquely positioned to redefine and lead the collectibles experience in Southeast Asia,” he added.

According to the statement, Hoopi’s founders, who bring significant entrepreneurial backgrounds from the gaming industry, identified a market opportunity in Southeast Asia’s fragmented toy collectibles and trading cards market, characterized by authenticity concerns and transparency issues.

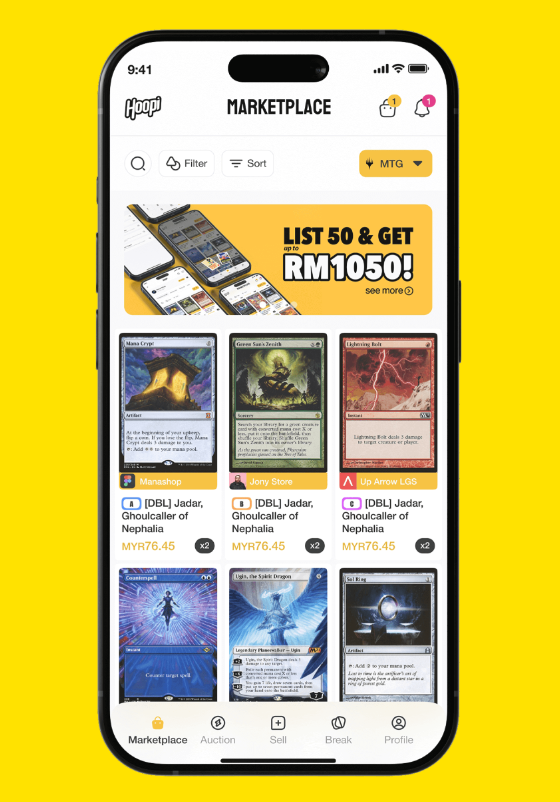

To address these challenges, Hoopi offers a comprehensive suite of services, including a consumer-to-consumer marketplace, an auction-based card trading, local card grading services, and gamified experiences for rare, high-value collectibles.

Additionally, the firm is the strategic partner of Robbi Art for the Southeast Asian region.

Robbi Art is a premium toy collectible brand known for its collaborations producing limited-edition figurines.

It is noted that Southeast Asia’s trading cards and toy collectibles market is estimated to be valued at $5.99 billion in 2025 and is expected to grow at a compounded annual growth rate (CAGR) of 3 percent to about $7 billion by 2030, driven by several key factors.

Central to the industry’s growth is the powerful role of nostalgia and emotional connection, as collectibles and childhood trading card games, often evoke cherished memories and a sense of personal history.

These items provide comfort and continuity, leading many individuals to retain them even during financial uncertainty.

Additionally, the market thrives on its deeply rooted, community-driven nature, with passionate and dedicated fanbases fostering ongoing engagement through tournaments, online forums, and collaborative events.

These communities not only sustain interest but also inspire innovation and sustain demand, ensuring that the market remains vibrant.

Furthermore, the perception of collectibles as alternative investments has gained traction, as rare or limited-edition items are increasingly viewed as tangible assets with the potential for long-term appreciation.

Together, these elements underpin the robust performance of the industry despite broader economic challenges.

“I am confident that the trading cards and collectibles market in Southeast Asia is poised for significant expansion, fueled by the region’s dynamic gaming culture and accelerating digital adoption,

“Hoopi’s innovative strategies, commitment to fostering community engagement, prioritization of sustained value creation, and operational agility position it to not only endure but excel in growing sustainable revenue streams amidst macroeconomic volatility in the region,” said Benz Julio Budiman, the managing partner of CGC.

According to him, the founding team’s deep industry expertise and demonstrated success in scaling previous ventures instils CGC’s full confidence in their capacity to address market complexities and drive Hoopi towards profitability.

“As Hoopi continues to advance innovation within the trading cards and collectibles sector, I am assured that Hoopi will not only capture substantial market share but also play a pivotal role in defining the future of trading cards and collectibles across Southeast Asia,” he added.

#CollectiblesSEA #TradingCardsMarket #HoopiExpansion #GamifiedCommerce #AlternativeInvestments

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness