Hong Leong sees Malaysian government supportive policies to provide competitive advantage in data center amid US AI chip curbs

While the recent US Framework for AI Diffusion presents a dent to Malaysia’s booming DC space, Hong Leong Investment Bank Research said Wednesday that Malaysian government supportive policies will provide a competitive advantage in data center (DC) investment.

The research house said in a note that Malaysia’s competitive advantage over its regional peers in the DC space stems in part from utility firm Tenaga Nasional Bhd (TNB)’s Green Lane Pathway (introduced Aug-23) – which expedites electricity supply for DCs, reducing implementation timelines from 36-48 months to a mere 12 months.

As DCs are electricity guzzlers, it noted the launch of Corporate Renewable Energy Supply Scheme (CRESS) (Sep-24) provides an avenue for large corporate consumers (including DC owners) to purchase renewable energy (RE) directly from independent power producers (IPPs) – this should appeal to DC investors that are members of RE100 (e.g. Bridge Data Centres, Microsoft, Google, EdgeConneX, Amazon, etc.).

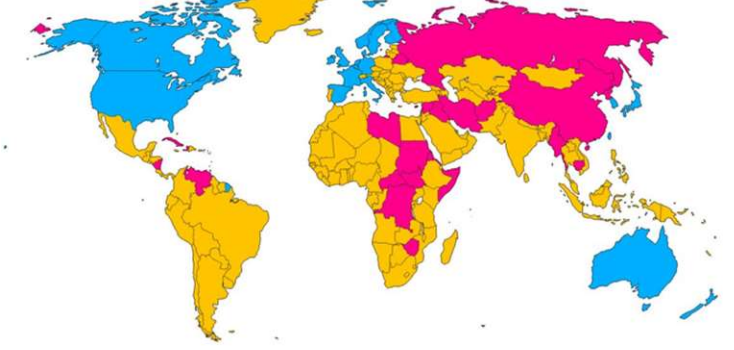

“With ASEAN countries mostly on the same tier boat – i.e. none are Tier 1, most are Tier 2, while some are Tier 3 – we reckon that Malaysia’s supportive DC policies will continue to accord it a relative advantage in the region,” said the research house.

Despite the recent AI chips restrictions denting the prospects of Malaysia’s DC market, Hong Leong also takes solace from the fact that 91 percent of the $23.3 billion major investments announced over the past year came from global tech giants that are headquartered in the US.

“This could likely enable them to obtain a universal verified end user (UVEU) status, allowing them to import graphics processing units (GPUs) for their Malaysia based AI-DCs,” it said.

Meanwhile, with the recent framework being proposed during the final days of the Biden administration, and with Trump now helming the presidency, Hong Leong believes that (perhaps optimistically) there is potential for this to be rejigged over the 120 comment period – hopefully with softer restrictions.

To recap, the framework has drawn criticism from the likes of Nvidia and the Semiconductor Industry Association (SIA), as well as EU nations where 17 of its 27 member countries

will face restrictions.

Although not directly related to the framework on AI chip curbs, Hong Leong noted that the newly minted president has deviated from some of Biden’s policies, namely (i) delaying the ban on TikTok and (ii) revoking the executive order on regulating AI.

Cited Knight Frank, Hong Leong highlighted that Malaysia’s existing DC information technology (IT) capacity stands at 505MW as of Dec-24, with future supply (under construction and committed) at 1,313MW – implying an eventual increase of +260 percent from current levels.

Separately, based on estimates by SemiAnalysis, it said Malaysia’s critical IT capacity stood at 792MW in 2024, and is projected to hit 3,240MW by 2027 – translating to a CAGR of 92 percent.

“SemiAnalysis reckons that the only use case for such an enormous sum of DC capacity is for AI,

“At the onset, this insinuates that Malaysia could be one of the key risk countries from the new AI chips restriction rules,” said the research house.

It is also noted that Deputy Ministry of Investment, Trade and Industry (MITI) minister of Malaysia Liew Chin Tiong recently said that the recent export limitations on AI

chips is not expected to impact the operations of existing DCs in Malaysia – though staying conspicuously silent on its implications to the pipeline of new AI-DCs.

#MalaysiaDataCenters #AIDevelopment #RenewableEnergy #TechInvestment

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness