China’s collectible card craze: Kayou and major IPs drive a growing market

A trading card resurgence led by China’s youth could ignite a new pop culture wave.

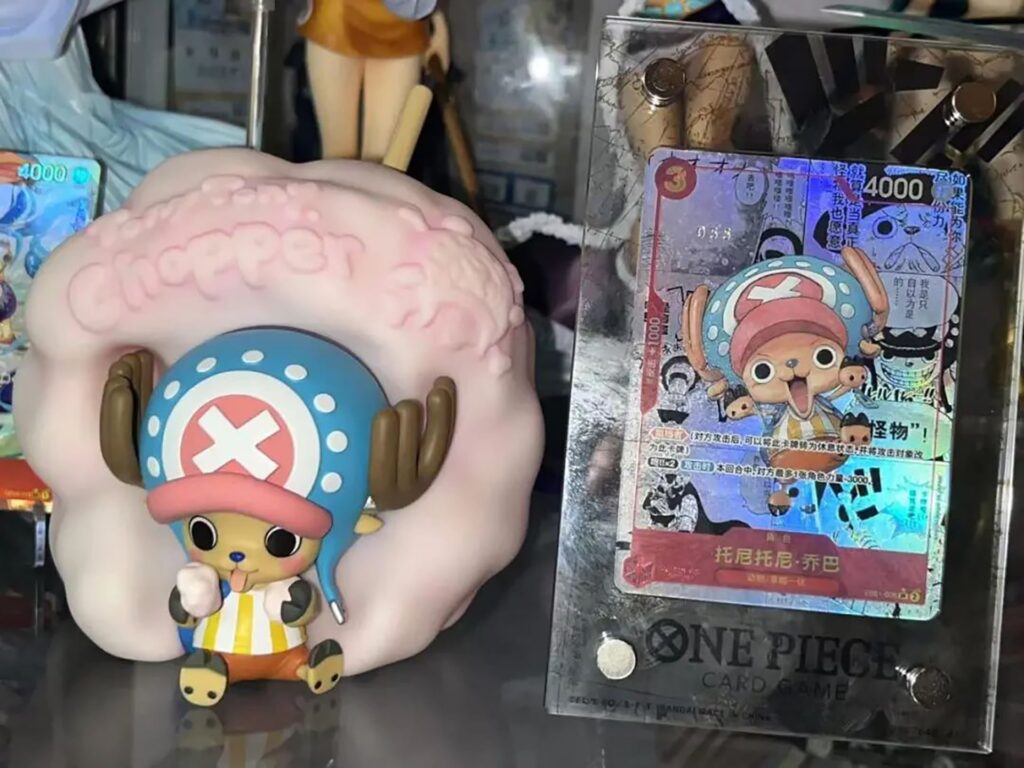

Inside a Kayou flagship store in Beijing on a weekend, young visitors peruse thick binders filled with collectible trading cards from diverse IPs. They come to trade, chat, and expand their collections—a hobby sparking fresh connections for China’s next generation.

For many, trading cards are laced with nostalgia. Memories of classic IPs like Pokemon, Yu-Gi-Oh, and Magic: The Gathering from the 1990s have laid fertile ground for a new wave of trading card enthusiasm. Today’s youth are diving into cards from fresh IPs like Ultraman, My Little Pony, and Kayou’s Three Kingdoms.

Data from 36Kr shows My Little Pony cards as a top topic on Xiaohongshu this year, even surpassing Pop Mart’s Labubu in popularity.

This trading card craze has swept through China’s younger generation. A 36Kr survey found that 36.15% of young Chinese have collected cards, second only to book and toy collectors.

A 2023 report by iResearch on China’s trading card market highlights five drivers behind the trend: expansive fan bases, emotional appeal, entertainment value, rising consumer spending power, and the thrill of “card draw” mechanics. Together, these factors shape card collecting as a versatile pastime—one that can be competitive, social, and deeply personal.

But this passion extends beyond just the young—many older collectors remain captivated by the classic IPs they grew up with. Caicai (pseudonym) began collecting as a middle schooler with competitive games like Yu-Gi-Oh. Now, well into his career, he hasn’t lost his enthusiasm. “I still buy a few packs on my lunch breaks,” he told 36Kr.

Caicai noted a generational crossover at card exhibitions, with parents and children alike searching for new finds. “Every generation has its ‘treasures.’ For us, growing up with cards is a legacy we can share with our kids,” he said, adding that card culture fosters a welcoming, close-knit community.

Design and IP play a major role in a card’s allure. In China, collectible cards generally fall into two categories: IP cards and celebrity cards. IP cards dominate, with iResearch noting that in 2022, China’s IP card market reached RMB 8.67 billion (USD 1.2 billion), marking a 34.9% annual growth rate and outpacing the celebrity card market fourfold.

For most collectors, trading cards are a way to invest in beloved IPs, with classic IPs connecting across generations. Caicai, for example, collects IPs like My Little Pony, One Piece, Digimon, and Pokemon. “Classics are worth revisiting,” he said, reflecting on his decade-long journey as a collector.

A recent surge in interest around anime and manga culture has also fueled the market. Data from Ocean Engine shows related searches spiked by 39% this year and by 370% over the National Day holiday, as anime- and manga-themed products became popular travel souvenirs among young people.

For pan-anime fans, merchandise has become essential, with 56% buying IP-related products. Cards are just one piece of the puzzle for collectors like Caicai, who also collects other merchandise related to favorite IPs—a mentality he said is common in his circle.

These items, including trading cards, act as a form of social currency among pan-anime fans, and brands like Kayou are rapidly responding by adapting IPs into card collections. For instance, though My Little Pony first aired in China in 2013 for younger viewers, Kayou launched it as a collectible card series in 2020, attracting fans of all ages.

“When I was younger, it was just IPs like Yu-Gi-Oh,” Caicai said. “Now, we have everything from classic anime to new releases—some just weeks after they debut.” Brands like Kayou have matured to meet this demand, establishing themselves as leaders in the trading card market.

Kayou’s Three Kingdoms series, along with IPs like Naruto, Crayon Shin-chan, Hero Battle, Identity V, Jujutsu Kaisen, Mo Dao Zu Shi, and SpongeBob SquarePants, now represent 12 of the top 20 trading card brands on the Qiandao app. According to Kayou’s prospectus, it held a 71% share of China’s collectible card market in 2022, with the next four companies collectively holding just 5.7%.

The collectible card market appears poised for a boom, mirroring the blind box toy market’s rise four years ago. The Huajing Industry Research Institute forecasts that the global collectible card market, valued at USD 11.13 billion in 2020, will grow to USD 31.26 billion by 2027, marking a 15.9% compound growth rate from 2021–2027.

Pop Mart, a leader in trendy toys, showcases the potential for international expansion. In the first half of 2024, Pop Mart’s overseas revenue, including sales from Hong Kong, Macau, and Taiwan, surged by 259% year-on-year to reach RMB 1.35 billion (USD 189 million).

Pop Mart’s success underscores the importance of high-quality products and IP expertise—an approach Kayou aims to emulate globally. On October 17, Kayou announced a partnership with Hasbro to license the My Little Pony IP worldwide. The collaboration kicked off with a pop-up event, “Pinkie Pie’s Party,” in Shanghai’s Jing’an Joy City, unveiling My Little Pony cards in English and Japanese, with launches planned for Southeast Asia, Japan, and South Korea.

Chinese trading cards are already reaching international markets through e-commerce and resellers. On platforms like X (formerly Twitter) and TikTok, users share reviews of Kayou’s Naruto cards, with thousands of likes and shares.

While trading cards are relatively new in China, North America and Japan have over a century of card culture with robust, established markets. This suggests that Chinese-made cards already face a certain degree of competition overseas.

Quality is therefore essential. For one, IP-based products must meet high manufacturing standards. Kayou has invested in five production bases across Zhejiang and Guangdong and an intelligent card and stationery park in Zhejiang. They employ Manroland automatic printing lines for double-sided card printing, plus advanced techniques like cold stamping, holographic printing, and 3D effect application.

The Transformers series, for example, features four-frame lenticular cards with gold foil, creating a dynamic look that animates the Transformers on each card.

Kayou’s trading cards also serve as a vehicle for Chinese culture abroad. Besides licensing international IPs, the company introduces Chinese IPs to global audiences. Kayou’s Three Kingdoms cards appeared at the Foire de Paris, and its original Hero Battle anime is serialized in both China and Japan.

In July, a unique scene unfolded in front of Paris’s Arc de Triomphe, where Chinese volunteers showcased Baduanjin cards, inviting passersby to try poses from this ancient fitness practice. Tourists joined in, experiencing a slice of Chinese culture.

As global curiosity about Chinese culture grows, these small cards serve as a medium to bridge cultures, inviting international consumers to appreciate the craft, style, and stories behind Chinese IPs.

#TradingCardResurgence #PopCultureWave #ChineseIPExpansion #GlobalCardMarket #Ifvex

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness