Malaysia Venture Forum 2024 opens in KL, brings together public & private sectors to discuss future of VC ecosystem

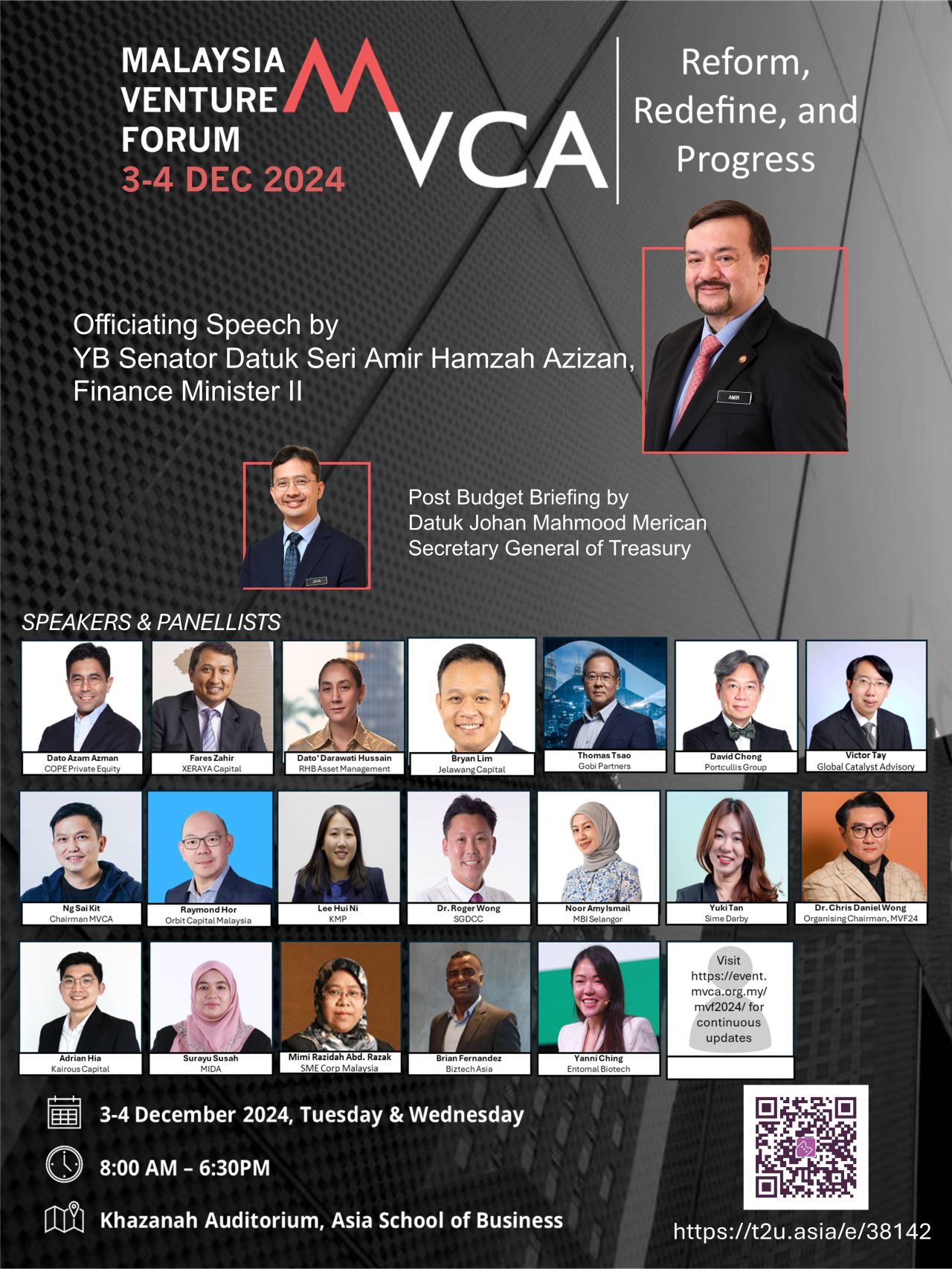

The 2024 edition of the Malaysia Venture Forum opened on Tuesday, bringing together key stakeholders from the public and private sectors to discuss the future of Malaysia’s venture capital (VC) ecosystem.

The forum was officiated by Amir Hamzah Azizan, Minister of Finance II, who stressed the role of VC in driving innovation, economic growth, and job creation, according to a statement.

“Under the Ekonomi MADANI framework, venture capital is a critical lever in driving technological progress and building an inclusive, high-value economy that uplifts all Malaysians.

“At $758 million in 2022, total venture capital funding in Malaysia trailed behind established and emerging Asian hubs like Indonesia ($3.9 billion) and South Korea ($9.5 billion). Our aspiration is to double this value by 2030”, added Amir Hamzah.

Malaysia’s Collective Effort in Supporting VC and Start-ups

To this end, Ministry of Finance-led initiatives such as GEAR-uP have been formulated with a pledge of MYR120 billion over the next five years towards high-growth and high-value industries, including VC and start-up funding.

Under Budget 2025, several key initiatives were introduced to strengthen support for startups and VC, including MYR200 million allocated in 2025 under KWAP’s Dana Perintis fund and MYR65 million under The Cradle Fund (to assist start-ups in scaling regionally and globally).

A further MYR300 million has been earmarked for deployment in 2025 by the national fund-of-funds, Jelawang Capital.

Bryan Lim, Chief Executive Officer of Jelawang Capital and Khazanah’s Head of Dana Impak, said, “Jelawang Capital’s vision is for Malaysia to have a vibrant entrepreneurial ecosystem, via the provision of capital to skilled fund managers, who will in turn invest in high-potential startups. Our recently launched Emerging Managers’ Program (EMP) hopes to nurture the next generation of Malaysian fund managers while the Regional Managers’ Initiative (RMI) aims to elevate Malaysia’s startup ecosystem through strategic partnerships with regional firms.”

“Beyond these initiatives, Jelawang Capital is proud to act as secretariat to the Malaysia Venture Capital Roadmap (MVCR) and as a bridge between policymakers and the private sector. In that respect, we look forward to working with like-minded partners in realising Malaysia’s vision of being a key VC hub by 2030”, Lim added.

Ng Sai Kit, Chairman of the Malaysian Venture Capital and Private Equity Association (MVCA) remained bullish on the outlook of the industry.

“While small, Malaysia’s VC ecosystem remains full of potential, aided by the depth of its capital markets and mature legal frameworks. However, more can be done. In that regard, we applaud the government’s commitment to regulatory reform and capacity building, as encapsulated in the MVCR. As the leading organization for Malaysia’s venture capital and private equity industry for nearly 30 years, we look forward to continuing to partner with both the private and public sector to make our VC ecosystem more vibrant”, he said.

Whole-of-nation approach for a Collective Goal

Notwithstanding the high-risk, high-reward nature of VC investments, Amir Hamzah added that they are part and parcel of a dynamic capital ecosystem and that Malaysia’s investment institutions remain committed to balancing calculated risk-taking with sound governance.

The Minister of Finance II called for all stakeholders to collaborate in building a thriving VC ecosystem. “A diversified funding landscape is essential. All ecosystem players — GLICs, private sector investors, and start-ups — play critical roles in energizing Malaysia’s VC ecosystem and accelerating its evolution. Together, we can build an ecosystem that uplifts our economy, empowers our people, and leaves a legacy for generations to come”, he concluded.

#MalaysiaVentureForum #VentureCapital #Startups #EkonomiMADANI #InnovationEconomy

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- ເກມ

- Gardening

- Health

- ໜ້າຫລັກ

- Literature

- Music

- Networking

- ອື່ນໆ

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness