Intel CEO Pat Gelsinger steps down amid turbulent tenure

Gelsinger’s sudden departure leaves Intel at a crossroads, grappling with AI missteps and the challenges of its IDM 2.0 strategy.

On the evening of December 2, Intel announced on its official website that its CEO, Pat Gelsinger, would retire and step down from the board of directors.

“This came completely out of the blue—an email without any prelude,” several Intel employees told 36Kr. The announcement caught many by surprise, especially since just four days earlier, Gelsinger had visited the Memphis data center run by Elon Musk’s xAI, sharing a photo on social media of himself wearing safety gear and pointing to an Intel chip.

What was even more bizarre was that a company with a 56-year legacy announced this major leadership change without naming a successor. The timing was particularly awkward, as Intel is currently embroiled in ongoing layoffs and surrounded by persistent rumors of a potential acquisition.

According to Intel’s official statement, Gelsinger’s duties will temporarily be handled by David Zinsner, Intel’s CFO, and Michelle Johnston Holthaus, head of the Client Computing Group (CCG). Intel also announced that it is actively searching for a suitable CEO successor.

Pat Gelsinger, a 49-year veteran of Intel who served as the company’s first CTO and spent four years as CEO, has exited abruptly. The announcement has drawn shock from many, but for others, it feels inevitable.

“Most likely forced out”

“It’s probably not a retirement—he was most likely forced out,” several Intel employees speculated, according to 36Kr. This is not the first time Intel’s board has ousted a CEO, and it seems history is repeating itself.

The two CEOs before Gelsinger also left in similar circumstances. In 2018, then-CEO Brian Krzanich, who had worked at Intel for 36 years, faced a nearly identical situation. Despite his long tenure, Krzanich’s leadership failed to sustain Intel’s dominance in mobile and server chip businesses.

Krzanich was eventually ousted due to a personal scandal: he was discovered to be in a relationship with an Intel employee, violating the company’s “non-fraternization policy.” While both parties later emphasized that the relationship was consensual, the scandal ultimately led to his departure.

As for Gelsinger, evaluations of his four-year stint as CEO have been fairly consistent both inside and outside the company. From a financial perspective, Intel’s stock price halved during his tenure, and its market capitalization shrank by USD 150 billion, equivalent to the valuation of Meituan.

In contrast, Intel’s competitors have surged ahead in the artificial intelligence era. Nvidia’s stock price increased tenfold over the same four-year period, and AMD’s market capitalization grew by 80%.

CNBC offered a scathing evaluation, terming Gelsinger the CEO who destroyed the most market value. One Intel employee was more blunt, saying, “IDM 2.0 didn’t deliver—this was effectively a death sentence for Gelsinger.”

Investing in manufacturing at an inopportune time

Four years ago, Gelsinger inherited a struggling Intel. The company had been repeatedly missing deadlines for advanced semiconductor processes, earning it the derogatory nickname “toothpaste factory” for its slow progress.

Intel’s struggles reflected a broader shift in the global semiconductor landscape. As the industry increasingly moved away from the traditional Integrated Device Manufacturer (IDM) model—where chip design, manufacturing, packaging, and testing are all performed in-house—the sector gravitated toward a more specialized and efficient division of labor. Foundries in Taiwan, South Korea, and Japan quickly rose to prominence, capturing 80% of the global chip manufacturing market, while the US share dwindled to just 5%.

Intel’s competitors thrived under this new model of specialization, leaving it behind. In response, Gelsinger introduced the IDM 2.0 strategy during his tenure as CEO. This strategy was not only a key part of Intel’s revival plan but also aligned with the geopolitical demand for domestic chip manufacturing amid escalating global tech rivalries.

Under IDM 2.0, Gelsinger aimed to simultaneously pursue both internal and external manufacturing to maintain Intel’s edge in advanced semiconductor processes. His vision was ambitious: by 2030, Intel would become the world’s second largest foundry.

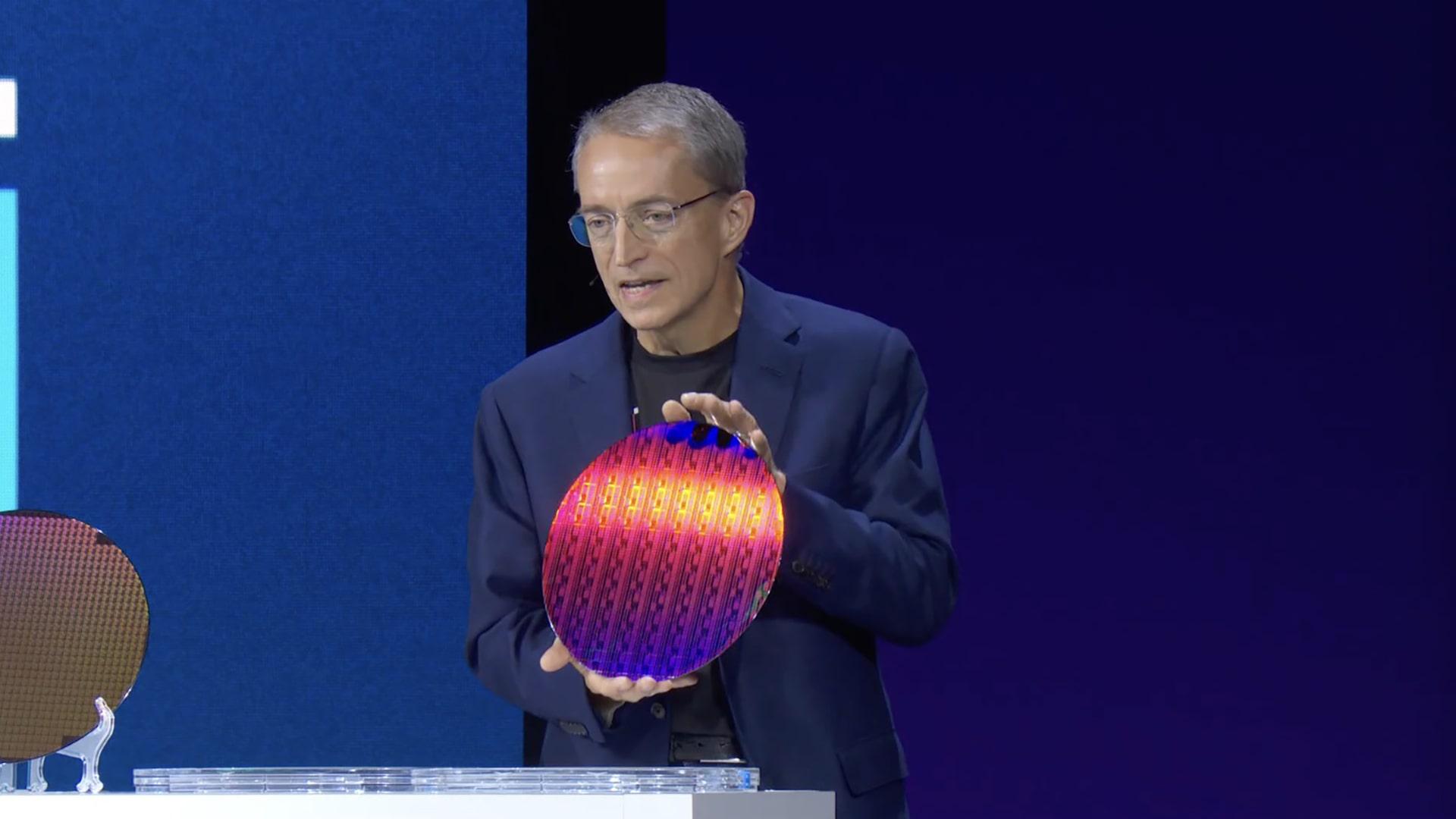

Some progress was made under IDM 2.0. Intel no longer missed process node deadlines as frequently as before. During the “Intel Innovation 2023” event, Gelsinger announced that Intel’s “five nodes in four years” plan was on track: Intel 7 had achieved mass production, Intel 4 was production-ready, and Intel 3 was expected to be launched by the end of 2023. Additionally, Intel explored innovations like glass substrates, open ecosystems for chiplet technology, and quantum chips.

However, chip manufacturing is a high-cost, long-payback business. Amid Intel’s ongoing financial losses over the past two years, this long-term strategy appeared increasingly ill-timed. Losses in the manufacturing division reached hundreds of billions of USD, while the division contributed only 2% of Intel’s total revenue in 2023.

Recently, four former Intel board members openly suggested that the US government should intervene to force Intel to split into two entities: one for manufacturing and one for design. They argued that this was the “only way for Intel to survive.”

One Intel employee summarized the dilemma: “From a US national perspective, IDM 2.0 was the right thing to do, but Gelsinger couldn’t carry the weight of this mission.”

Strategic missteps in the AI era

In addition to IDM 2.0, AI was another major strategic focus during Gelsinger’s tenure. Over the past two years, Intel invested in AI PCs (Core processors) and discrete GPUs (Gaudi series) to compete with Nvidia.

However, Intel’s AI efforts have been slow and inconsistent. Employees reported that the Gaudi series was deprioritized internally, as Gelsinger focused nearly all his energy on IDM 2.0. Even Gelsinger admitted to employees that Intel had not fully capitalized on trends like AI.

In contrast, AMD has made significant strides in AI chips. The company revealed that it has secured orders from over 100 AI customers and original equipment manufacturers (OEMs), and its data center server market share has risen from single digits to about 30%, making it AMD’s fastest-growing business segment.

A chip investor explained Intel’s struggles: “Intel’s traditional revenue comes from x86 architecture CPUs, but that market is being chipped away by ARM and RISC-V CPUs as well as emerging players.” The rise of generative AI, which drives demand for GPUs in intelligent computing centers, further disadvantages Intel. Nvidia dominates this space.

“Look at a single intelligent computing center node,” the investor said. “It has two CPUs and eight GPUs. The number of CPUs hasn’t changed, but the eight additional GPUs are all new business for Nvidia.”

Efforts to reform corporate culture

Despite Intel’s strategic missteps, Gelsinger made efforts to address the company’s bureaucratic culture. Historically known for its rigid structure, Intel under Gelsinger tried to revive the “Grove-style” culture of discipline, engineering excellence, and data-driven decision-making.

Gelsinger rebuilt Intel’s development processes, introducing a system called “Tick-tock 2.0,” which emphasized progress rhythm and risk management. He also redefined Intel’s goal-setting framework, improving performance tracking and coordination across teams.

Many employees described Gelsinger as a charismatic leader full of “American-style enthusiasm.” During last year’s Intel conference, he made a dramatic entrance by doing push-ups, reflecting his drive to leave a lasting legacy at the company.

However, as one employee noted, “For a CEO of a giant corporation, history judges by success or failure. If the most important goals aren’t achieved, everything else loses significance.”

As Intel’s market capitalization drops by the equivalent of “a Meituan,” the company now faces the challenge of finding a pragmatic leader to guide it through these troubled times.

#IntelLeadership #SemiconductorIndustry #AIChips #IDMStrategy #TechInnovation

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness