Deals in brief: B Capital leads Series A investment in Eureka Robotics, Cove attracts new funding, True Global Ventures backs US-based Prezent, and more

Bringing you the latest updates on funding deals and activities in the Asia Pacific.

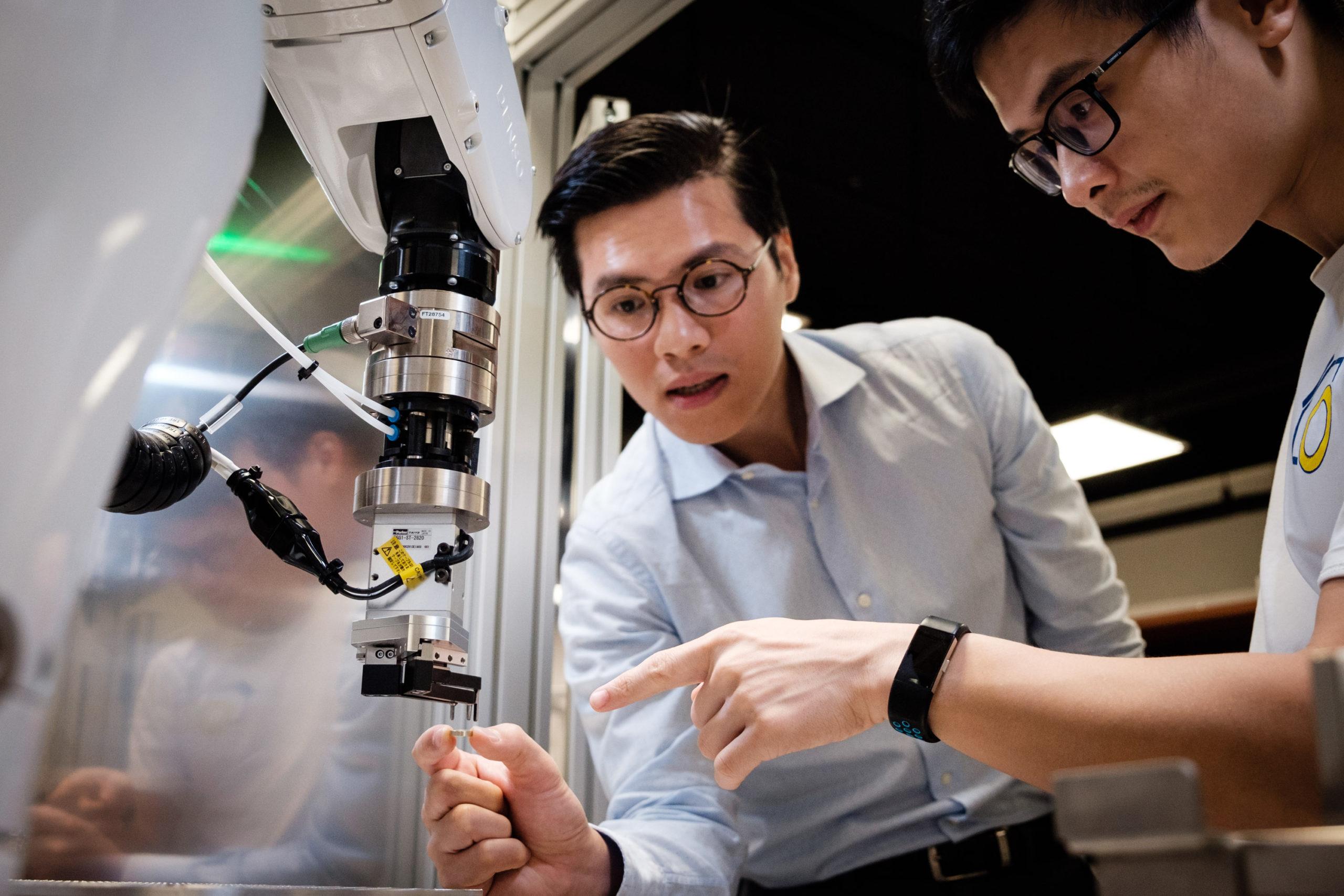

Eureka Robotics raises USD 10.5 million in Series A funding

Singapore-based robotics company Eureka Robotics has raised USD 10.5 million in a Series A funding round led by B Capital, with participation from Airbus Ventures, Maruka Corporation, G K Goh Ventures, UTEC, and ATEQ. The funding will support the advancement of Eureka’s flagship products: Eureka Controller, a hub for vision and robotics applications, and Eureka 3D Camera, which uses artificial intelligence-driven, projector-free technology for efficient 3D vision.

Founded in 2018, Eureka Robotics specializes in “high accuracy, high agility” robotics with applications in industries such as automotive and aerospace manufacturing. Its clientele includes major players like Toyota and Pratt & Whitney. The company plans to expand its presence in Japan and debut in the US market, where it has already signed on initial customers.

Cove raises USD 4.5 million, adds real estate veteran to board

Cove, a flexible living platform, has raised USD 4.5 million in its latest funding round, with real estate industry veteran Ashish Manchharam among the investors. Manchharam also joins Cove’s board of directors. Eurazeo and Keppel, existing stakeholders who took a minority stake in 2020, participated in the round.

The funding will fuel Cove’s asset acquisition-driven growth strategy and regional expansion, including planned launches of 800 rooms in South Korea and 400 in Japan.

True Global Ventures invests USD 7.3 million in Prezent

True Global Ventures (TGV), a Singapore-based venture capital firm, has invested USD 7.3 million in Prezent, a San Francisco-based company specializing in AI-driven storytelling solutions.

The funding, sourced from TGV’s Opportunity Fund, will support Prezent’s platform scaling and its expansion into Europe and Asia.

Prezent’s platform is tailored for enterprise communication, with clients primarily in the biopharmaceutical and telecommunications sectors.

R-Bridge provides USD 50 million financing to Human Investments

R-Bridge Healthcare Fund, managed by Asian investment firm CBC Group, has extended a USD 50 million non-dilutive financing facility to Human Investments.

The financing will be tied to sales milestones, providing support for the expansion of Motiva, Human’s medical aesthetics subsidiary, in South Korea and China.

Motiva recently received regulatory approvals in China for its breast health and reconstruction products.

Laam secures USD 5.5 million to broaden global reach in South Asian fashion

Lahore-based startup Laam has raised USD 5.5 million in a seed funding round co-led by Disrupt.com and Zayn VC, according to TechCrunch. Operating as a marketplace for South Asian fashion, Laam connects over 1,200 sellers to customers in more than 100 countries, with significant traction in the US, Canada, and the Middle East.

The new funding will enable Laam to establish a presence in the UAE and plan for entry into the US market. The company also offers sellers logistics and AI tools, such as inventory insights and fulfillment services.

Angitia Biopharmaceuticals raises USD 120 million in Series C funding

Angitia Biopharmaceuticals, with operations in the US and China, has secured USD 120 million in a Series C funding round led by Bain Capital Life Sciences. The round also saw participation from Janus Henderson, OrbiMed, and Legend Capital.

The funding will advance Angitia’s musculoskeletal treatment pipeline, including AGA2118, a dual-acting drug currently in Phase 2 trials for postmenopausal women.

Fleet Space, Pixxel, Rebel Foods, and more made recent headlines:

- Fleet Space Technologies, an Adelaide-based space exploration company, raised AUD 150 million (USD 96.2 million) in a Series D funding round led by Teachers’ Venture Growth (TVG). The round included returning investors such as Blackbird Ventures, Hostplus, Horizons Ventures, Artesian Venture Partners, and Alumni Ventures.

- Pixxel, a hyperspectral imaging startup based in the US and India, raised USD 24 million in a Series B extension, pushing the round’s total to USD 60 million. M&G Catalyst and Glade Brook Capital Partners joined existing backers like Google and Lightspeed in the latest tranche.

- Rebel Foods, a leader in India’s cloud kitchen space, reportedly received USD 210 million in its Series G funding round, led by Temasek Holdings with support from existing investor Evolvence.

#AsiaFunding #StartupEcosystem #Innovation #VentureCapital #TechNews

- Nghệ thuật

- Nguyên nhân

- Thủ công

- Nhảy múa

- Đồ uống

- Phim ảnh

- Tập gym

- Thực Phẩm

- Trò chơi

- Làm vườn

- Sức khỏe

- Trang chủ

- Văn học

- Âm nhạc

- Mạng

- Khác

- Buổi tiệc

- Tôn giáo

- Mua sắm

- Thể thao

- Nhà hát

- Sức khỏe