AI’s energy appetite revives nuclear ambitions in the US

Facing grid strain, tech giants are turning to nuclear power to meet AI-driven energy needs, fueling a new wave of reactor projects despite challenges.

A nuclear power plant shut down 45 years ago will soon restart—because artificial intelligence needs too much electricity.

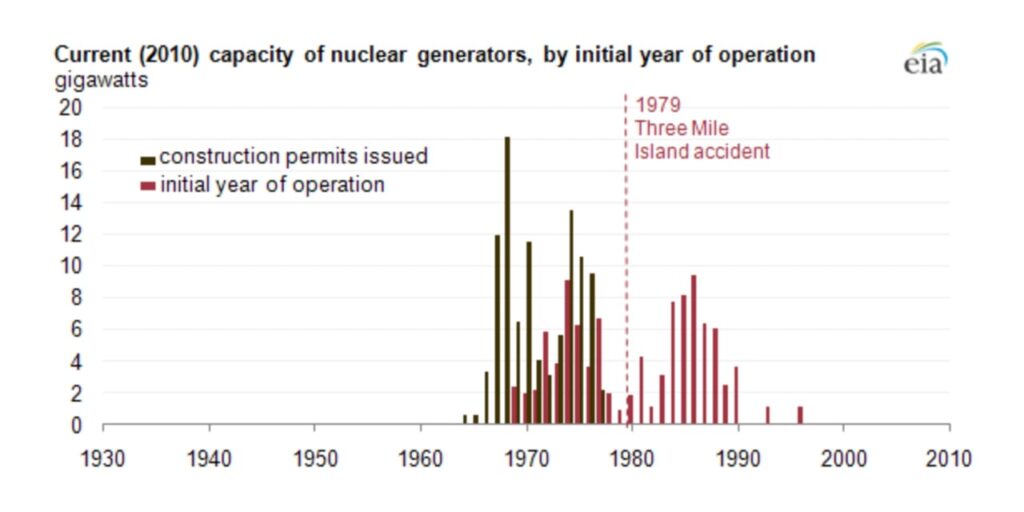

In 1979, the Unit 2 reactor of the Three Mile Island (TMI) Nuclear Generating Station near Harrisburg, Pennsylvania, experienced a partial meltdown, releasing radioactive materials in one of the most severe nuclear accidents in American history.

Cleanup efforts for the incident continued until 1993. While Unit 1, located adjacent to the damaged reactor, resumed operations in 1985, it was permanently shut down in 2019 due to competition from cheaper natural gas, wind, and solar energy sources.

Now, however, TMI is being revived under a new name: the Crane Clean Energy Center (CCEC).

In September, Microsoft announced a historic power purchase agreement with Constellation Energy Corporation to buy 100% of the electricity generated by TMI over the next 20 years. This power will fuel Microsoft’s AI data centers and cloud services.

According to data from The Wall Street Journal, tech giants heavily investing in AI are negotiating with nuclear power plant operators, involving approximately one-third of all nuclear facilities in the US.

Earlier this October, Google signed an agreement with Kairos Power to purchase electricity from 6–7 planned small modular nuclear reactors (SMRs) with a total capacity of 500 megawatt-hours. In March, Amazon bought a nuclear-powered data center for USD 650 million, and Oracle announced plans to design a data center powered by three SMRs.

The ripple effects are evident in the stock market: nuclear energy stocks have surged. Vistra Corporation, for instance, has become the best-performing company in the S&P 500 this year, with its stock price soaring 303.53%.

Why nuclear power?

How energy-intensive is AI? Reports indicate that a single training session for GPT-4’s GPUs consumes 240 million kWh of electricity. This figure doesn’t even account for the energy needs of supporting infrastructure like servers and cooling systems.

Running ChatGPT also requires significant electricity. According to The New Yorker, it is estimated that ChatGPT consumes over 500,000 kWh daily—the equivalent of the average annual power consumption of 17,000 American households.

Bank of America Merrill Lynch’s research forecasts that AI-related electricity consumption in the US will grow at a compound annual rate of 25–33% between 2023 and 2028, much higher compared to the 2.8% growth rate for overall electricity demand.

With the rapid expansion of data centers, the aging US electrical grid—largely built in the 1960s and 1970s—is under unprecedented strain. Tech companies are scrambling to acquire grid access, building data centers in less developed regions like Ohio and Iowa to secure stable power supplies.

In March, Elon Musk warned that, by next year, there might not be enough electricity to power all the chips in operation.

This has made nuclear power—with its efficiency and reliability—a top choice for tech companies ensuring uninterrupted electricity supply.

The US Energy Information Administration (EIA) reports that nuclear power has a capacity factor of 93.1%, meaning it operates at maximum power more than 93% of the time. Additionally, nuclear plants provide baseload power round the clock, unaffected by weather, regional, or seasonal variations.

Research from China International Capital Corporation (CICC) highlights the unmatched energy density of nuclear power: 1 kilogram of uranium-235 generates energy equivalent to 2,700 tons of coal or 1,700 tons of crude oil.

Even more crucially, uranium—essential for nuclear energy—is becoming scarcer. According to Huayuan Securities, the natural uranium market is highly concentrated, with low-cost uranium primarily sourced from Kazakhstan. In August, Kazatomprom, the world’s largest uranium miner, announced significant production cuts for next year. Moreover, Kazakhstan plans to raise mining taxes on uranium to 9% by 2025 and 18% by 2026.

Are SMRs the solution?

As tech companies look toward nuclear power, the development of SMRs is gaining attention as a flexible and market-oriented solution.

A recent report from CITIC Securities highlights that SMRs, typically ranging from 15–300 megawatts in capacity, are smaller, more flexible, and cheaper to build and maintain compared to traditional large nuclear power plants, making them well-suited for powering data centers.

Amazon has set the tone for the industry. In October, it and Google announced milestone power agreements to accelerate SMR deployment in the US. OpenAI CEO Sam Altman, an investor in nuclear power company Oklo, aims to bring several SMRs online by 2030.

This trend has sent SMR developers’ stock prices soaring. Over the past three months, shares of NuScale Power and Oklo have risen by 249% and 259%, respectively.

However, the financial performance of these companies contrasts sharply with their stock gains. In Q3, NuScale’s sales fell 93.2% year-on-year to USD 475,000, with a net loss of USD 45.5 million. Oklo reported a per-share loss of USD 0.08, accumulating USD 37.4 million in operating losses this year alone.

Short seller Kerrisdale Capital called Oklo a “story stock,” noting its lack of revenue, regulatory approval, or verified commercial feasibility for its SMR designs. Oklo has projected deployment of its first reactor by 2027, but Kerrisdale cited a former US NRC commissioner who described the timeline as “beyond optimistic,” estimating it could take at least four years just to secure licenses.

While SMRs are hailed as a beacon of hope for nuclear power, market skepticism persists due to uncertainties around timely and budget-conscious completion, high interest rates, and a lack of clients willing to underwrite initial projects.

The challenge of reviving US nuclear power

“The only constraint on the US remaining the leader in AI is power,” said Clay Sell, CEO of X-energy, an Amazon-backed SMR developer. “It’s not land, it’s not chips, it’s power.”

The AI arms race is no longer bottlenecked by chips but by power. Thus, America’s push for a “nuclear renaissance” is urgent, though laden with challenges.

The Biden administration’s roadmap aims to deploy 200 gigawatts of nuclear capacity by 2050 through new reactors, restarts, and facility upgrades, with a short-term goal of adding 35GW within the next decade. Yet historically, US nuclear energy policies have often fallen short, failing to deliver substantial progress.

TMI’s 1979 meltdown remains a pivotal moment in US nuclear history. Though no casualties resulted, the incident shattered public confidence in the “absolute safety” of nuclear energy.

Since then, infrastructure-building capabilities in the US have declined significantly. Between 1979 and 1988, construction plans for 67 reactors were canceled. Georgia’s Vogtle Unit 3, which went online in July 2022, was the first new US reactor in over three decades. It remains the only commercial nuclear project actively pursued in the current century.

This stagnation has pushed tech companies toward decommissioned nuclear plants. However, facilities like TMI are rare exceptions, and reactivating retired plants won’t solve the underlying issues.

Another concern is the aging fleet of operational reactors. As of April 2024, the average age of US commercial nuclear reactors is 42 years. Aging equipment increases safety risks, reduces efficiency, and raises maintenance costs. Replacing outdated reactors and accelerating next-generation builds are critical challenges for the US nuclear industry.

Beyond technical and financial hurdles, nuclear projects face regulatory complexities and public concerns over safety and waste management, making new construction exceedingly difficult.

The road to a nuclear-powered future remains fraught with uncertainty.

#NuclearEnergy #AIRevolution #CleanEnergy #SMRs #TechInnovation

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness