Airwallex gets approval to launch yield product in Singapore

Airwallex, a global fintech platform, announced Monday that its Singapore entity, Airwallex Capital (Singapore) Pte Ltd, has been granted a Capital Markets Services (CMS) license by the Monetary Authority of Singapore (MAS) to launch yield products in the country.

With this license, Airwallex said in a statement that it can now offer regulated investment solutions and custodial services to businesses in Singapore through its Airwallex Yield product.

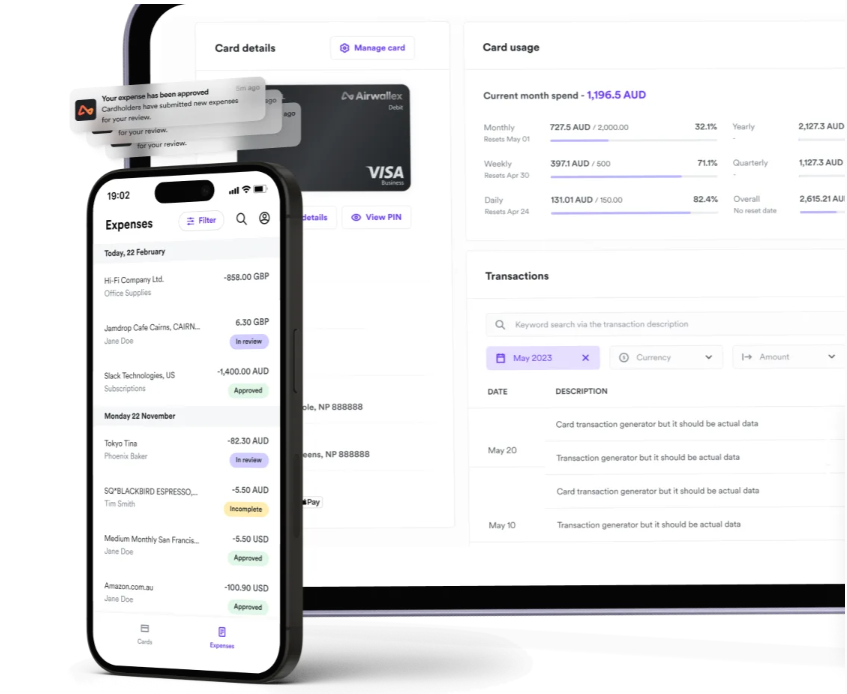

Airwallex Yield is an investment fund management service that allows businesses to earn competitive returns on surplus funds held within their business.

Through Airwallex Yield, businesses can maximize returns on their multi-currency funds by investing in highly rated money market funds; grow their foreign currency balances without opening additional accounts; maintain liquidity, with no lock-up periods, so businesses can move funds between cash balances and Yield accounts as needed to meet their growth needs.

Airwallex Capital is also collaborating with Fullerton Fund Management to manage its Singapore Dollar (SGD) investment strategy, and Goldman Sachs Asset Management for its US Dollar (USD) solution – both bringing deep institutional expertise to support customers’ needs.

“Launching Airwallex Yield in Singapore is a significant milestone as we continue to innovate and empower businesses here to unlock new opportunities to thrive,

“This is a proud moment for us, and we’re grateful to the MAS for their support and trust in our vision,” said Arnold Chan, General Manager, Asia Pacific, Airwallex.

Gary Harvey, Executive Director, Airwallex Capital (Singapore), said cash management is a crucial aspect of any business.

“With Airwallex Yield, we are giving businesses a simple and flexible way to grow their idle funds, empowering companies of all sizes to establish a more effective treasury function,

“We are delighted to be working alongside our trusted asset managers, Fullerton Fund Management and Goldman Sachs Asset Management, to deliver Airwallex Yield to businesses in Singapore,” he added.

Mark Yuen, Chief Business Development Officer, Fullerton Fund Management, said the firm’s partnership with Airwallex marks an exciting business channel for Fullerton, extending their institutional-grade investment expertise to a broader base of corporates in Singapore.

“In today’s complex and high-cost environment, businesses should expect more from their surplus cash – access to stable, liquid SGD cash solutions that also work harder to generate yield,

“With over 15 years of Treasury Management experience and S$13 billion ($10.14 billion) under management, Fullerton is well-positioned to support Airwallex Yield in delivering smarter cash solutions to meet evolving corporate needs,” he added.

Mike Siegel, Global Head of Liquidity Solutions and Co-head of the Client Solutions Group in Asia Pacific, Goldman Sachs Asset Management, said that an evolving market environment calls for effective liquidity management strategies.

“As one of the leading liquidity solutions providers in the world, we look forward to working with Airwallex in Singapore to help companies optimise returns on their cash balances while maintaining liquidity to meet business needs,” he added.

The launch of Airwallex Yield in Singapore follows successful rollouts in Australia and Hong Kong, reinforcing Airwallex’s strategy to shape the future of global finance, empowering companies to grow faster, smarter, and on their own terms, said the statement.

#FintechInnovation #BusinessInvestments #CashManagement #SingaporeFinance #GlobalLiquidity

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness