Singapore’s BetterX secures $1.72M in Pre-Series A funding to expand into Asia, the Middle East, and the US

BetterX, a Singapore-based digital asset-focused business to business (B2B) platform, has successfully closed a S$2 million ($1.72 milion) pre-Series A funding round.

The round saw participation from existing investors, including Aura Group and Tibra Co-founder Kinsey Cotton, alongside new investors such as Sydney’s Grand Prix Capital,

Singapore’s Aument Capital and angels including Sabrina Tachdjian (the Head of Fintech and Payments at HBAR Foundation) and Riaz Mehta (the Founder of Crypto Knights), BetterX said in a statement on Monday.

The new investors join existing investors Scalare Partners , Wholesale Investor, B7 Capital and the Founder of Audacy Ventures in the round.

Now profitable in its Australian operations, BetterX will use the funds to accelerate expansion into Asia and explore opportunities in the Middle East and the United States.

“We are thrilled by the strong backing from our investors, both existing and new, as we take BetterX to the next stage of growth,

“With the increasing institutional adoption of digital assets, we are committed to providing wealth managers with seamless, compliant, and institutional-grade solutions to

bridge traditional finance with the digital asset ecosystem,” said Adam Switzer, Co-Founder and Chief Executive Officer of BetterX.

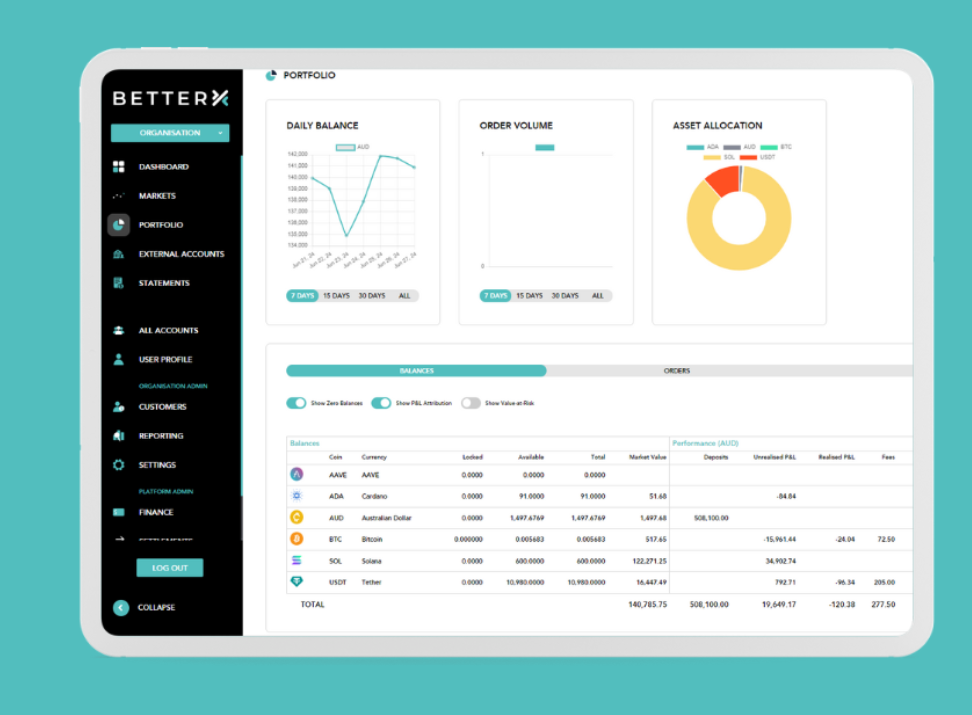

BetterX is a B2B platform enabling financial advisers to securely access, trade, and manage digital assets on behalf of their clients.

Designed to meet the highest standards of security, custody, and regulatory compliance, the firm provides institutional-grade infrastructure for tokenization, trading, and portfolio management.

The firm’s platform addresses key challenges in the digital asset space, including security, asset custody, and regulatory compliance.

By providing infrastructure for tokenization, trading, and portfolio management, the firm provides a platform for financial advisers and institutions to confidently integrate digital assets into their client offerings.

With regulatory clarity improving and demand for real-world asset tokenization growing, the firm said it is well-positioned to scale its innovative solutions to new markets.

#DigitalAssets #Fintech #Blockchain #Investment #WealthManagement

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness