Airwallex reports triple-digit full year revenue growth in Singapore for 2024

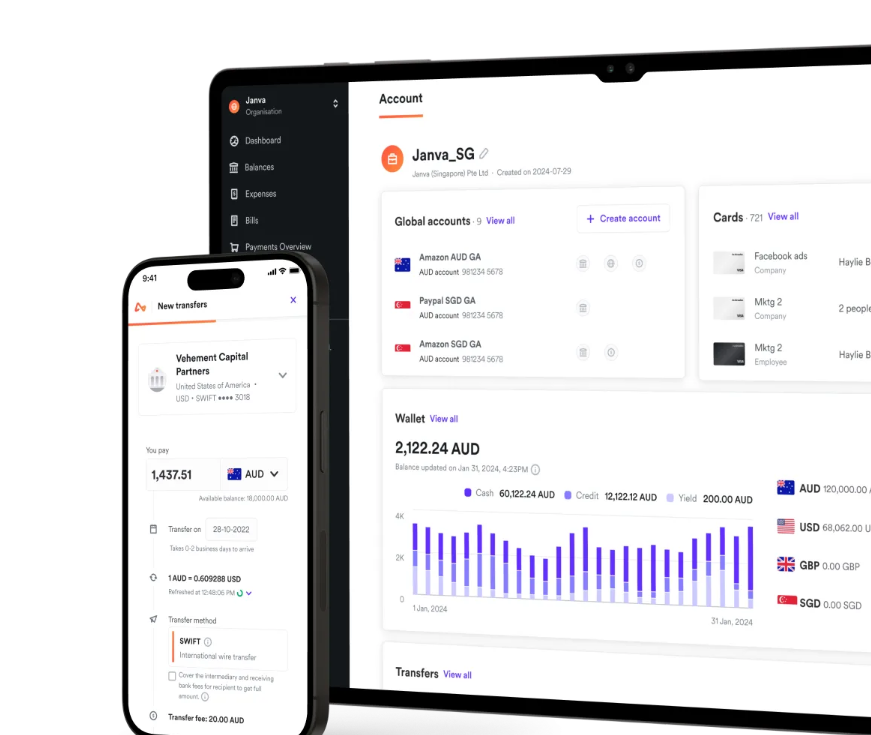

Airwallex, the global payments and financial platform, has on Wednesday reported strong FY2024 performance in Singapore.

The firm said in a statement that its FY2024 revenue in Singapore more than doubled, growing 153 percent year-on-year, fueled by strong transaction volumes and a standout fourth quarter.

“2024 marked a new phase of growth for us in Singapore and across the region,

“Our 2024 performance in Singapore shows what’s possible when businesses have access to powerful financial infrastructure,” said Lucy Liu, President and Co-founder, Airwallex.

According to her, the firm’s unrivaled tech platform and infrastructure spanning the globe provide businesses here with the solution they need to unlock their cross-border opportunities.

“Airwallex is proud to partner with them and welcome them into our network. These partnerships continue to drive our growth, and we’re now scaling that momentum across the region,

“Singapore’s strong tech talent pool and vibrant digital economy have also been key to fuelling our expansion,” she added.

According to the statement, the firm’s Singapore’s fourth quarter results were particularly strong, with revenue jumping 215 percent and transaction volume up 192 percent year on year.

Across 2024, Singapore’s transaction volume rose 159 percent.

Airwallex has also expanded its local footprint with brands like Endowus, Love, Bonito, and Mighty Jaxx, while continuing to empower customers such as EU Holidays, Far East Flora, and Huber’s Butchery, helping them grow and digitalize.

Throughout FY2024, Airwallex grew its headcount in Singapore by 58 percent.

As of early 2025, the company has more than 250 employees based in its Singapore office, which serves as its global headquarters.

Hiring spanned corporate, commercial, and product, engineering and design (PED) functions, with PED seeing the strongest growth – a 98 percent increase – as the company invested heavily in building out its artificial intelligence (AI), data, and engineering teams.

To support this growth, Airwallex expanded its office footprint in

Singapore, taking up additional space on a new floor at its current premises in Guoco Tower.

Meanwhile, the firm’s recent study showed that rising costs remain the most pressing issue for small and medium-sized enterprises (SMEs), cited by 62 percent of respondents.

This is followed by challenges managing cash flow both globally and locally (48 percent) – highlighting the growing demands of financial management for SMEs operating across borders.

Inflation (43 percent) and regulatory complexity (40 percent) were also major concerns, reflecting the broader pressures businesses face in today’s environment.

Meanwhile, talent constraints are another major pressure point as nearly half (46 percent) of SMEs highlighted the lack of suitable manpower as a barrier to growth, with many pointing to skill mismatches and labor shortages as key hiring challenges.

The study also showed SMEs are maintaining an expansion-first mindset, with Southeast Asia emerging as the top destination for overseas growth (40 percent), followed by East Asia (37 percent), and Central Asia (30 percent).

A majority of businesses are also increasing spending (76 percent), with one in three (33 percent) significantly boosting investment, pointing to a clear focus on growing revenue, improving efficiency, and capturing market share.

It is noted that as businesses scale, many are turning to digital and fintech solutions to manage rising complexity in financial operations – from improving cash flow visibility to navigating compliance requirements across borders.

Nearly all SMEs surveyed (96 percent) have either adopted or plan to onboard digital or fintech platforms to support their business finance needs, citing convenience, faster transactions, cost savings, and stronger features as key drivers.

Notably, 91 percent also said they trust fintech platforms to manage their financial operations. This marks a clear shift away from traditional financial systems that are struggling to keep pace with SME needs.

“SMEs are crucial to Singapore’s economy. They make up 99 percent% of all businesses and contribute nearly half of the nation’s gross domestic product (GDP),” said Ershad Ahamed, Head of Southeast Asia, Airwallex.

According to him, the research shows they’re ready to grow and expand into new markets, despite the challenges they face.

“Understanding their pain points allow us to design and provide products and services that address their priorities and pressures,

“As their partner, we’re here to empower them to scale with smarter, more resilient financial tools – addressing the various financial pressures they encounter with the speed, transparency, and efficiency our solutions provide,” he added.

Founded in Melbourne in 2015 and now headquartered in Singapore, Airwallex continues to experience strong global growth momentum.

In early 2025, it announced its official launch in New Zealand and

acquisition of CTIN Pay, an Intermediary Payment Service (IPS) licensed company in Vietnam.

The company also surpassed $600 million in annualized revenue and $130 billion in annualized transaction volume.

#AirwallexGrowth #FintechInnovation #SMEsExpansion #DigitalFinance #CrossBorderPayments

- Nghệ thuật

- Nguyên nhân

- Thủ công

- Nhảy múa

- Đồ uống

- Phim ảnh

- Tập gym

- Thực Phẩm

- Trò chơi

- Làm vườn

- Sức khỏe

- Trang chủ

- Văn học

- Âm nhạc

- Mạng

- Khác

- Buổi tiệc

- Tôn giáo

- Mua sắm

- Thể thao

- Nhà hát

- Sức khỏe