DigitalAssets, FintechInnovation, WealthTech, RegulatedCrypto, FinancialWellbeing,

Hong Kong-based renewable energy (RE) specialist Clean Kinetics has announced it has raised S$4.3 million($3.34 million)in a Series A funding round to drive its asset development and international expansion plans in the renewables infrastructure space.

Clean Kinetics said in a statement this funding round was led by a couple of regional family office-backed private investors.

The investment will support the firm’s expansion plans and growing project pipeline, which targets to grow its solar assets portfolio and increase its various projects’ total capacity installed to >1.2GW in projects, across Singapore, Malaysia, United Arab Emirates, Saudi Arabia, Qatar, Jordan, and Thailand, where the firm has already established offices and project sites in.

As demand for power surges with higher industrial activity, electric vehicle (EV) adoption and artificial intelligence (AI) development via data centers along with supportive government policies, clean energy and electricity has emerged as a sustainable and highly cost-efficient solution.

In the Middle East, the United Arab Emirates (UAE) and Saudi governments have respectively established targets of 30 percent and 50 percent of electricity sources from renewable energy by 2030.

Clean Kinetics said the firm is well-positioned to support these clean energy infrastructure rollout plans in the Middle East, as well as in Southeast Asia.

“This is a very exciting time for Clean Kinetics. Our strong track record has led to us securing a bigger pipeline of projects and assets while providing more innovative solutions via our holistic monitoring and maintenance systems and financing platform,

“This successful round and level of capital raised – amidst the uncertainty in international trade and policies -reaffirms our unique proposition and capabilities to develop quality renewable energy assets globally, especially in our key markets which have rising energy infrastructure and power needs”, said Wilson Lee, Clean Kinetics Co-founder and Chief Executive Officer.

Meanwhile, the firm’s Co-founder and Chief Development Officer Lee Kah Lup said the investors bring deep expertise in sectors such as edible oils, hospitality, and real estate.

He said they also have clear plans to expand into health and wellness, traditional medicine, and sustainable industries.

”As strategic partners, their commitment to integrating renewable energy into their operations as part of broader sustainability initiatives presents valuable synergy,

“Together, we look forward to further growing our portfolio and strengthening our regional presence,” he added.

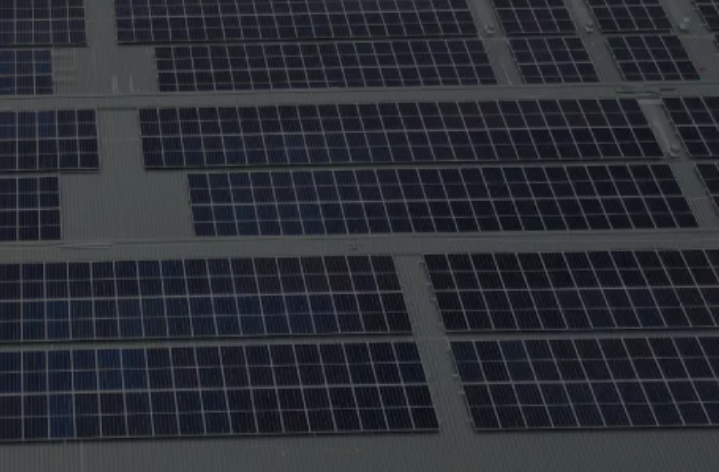

Clean Kinetics is a renewables firm with a strong presence and track record of delivering and operating solar and EV infrastructure solutions in Southeast Asia and the Middle East.

The firm has been involved in the successful installation of more than 1.4 million solar panels and over 800 MWp of capacity in total, across utility-scale and commercial & industrial projects globally.

#RenewableEnergy #CleanTech #SustainableInfrastructure #SolarPower #GreenInvestment

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness