Ant International’s Antom debuts agentic payment solution

Antom, a merchant payment and digitization services provider under Ant International, announced Thursday the launch of an agentic payment solution, featuring a first-of-its-kind secure APM checkout solution.

Ant International said in a statement that Antom is also among the first partners of Mastercard and Visa to pilot card-based transaction capabilities for artificial intelligence (AI) agents.

The partnerships which are via Mastercard Agent Pay and Visa via Visa Intelligent Commerce in Asia Pacific will explore tokenized card-based agentic payments, advancing AI commerce with secure and seamless checkout experience.

They will pilot reliable and personalized agentic payments with tokenization, authentication and transaction control tools.

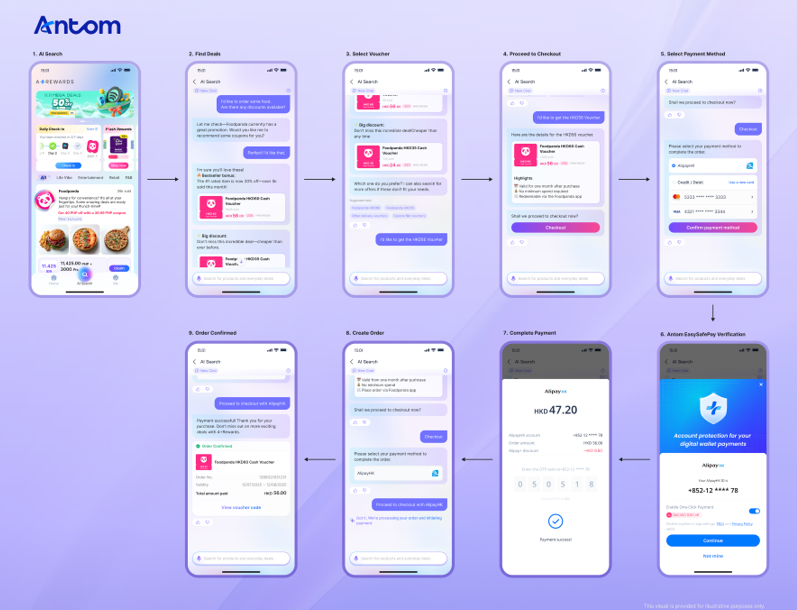

According to the statement, Antom’s agentic payment solution offers checkout through APMs and cards. It features an AI-ready payment mandate model and enhanced payment asset management to ensure precise recognition of user intent while safeguarding transaction security and providing increased transparency for users.

Building upon the Model Context Protocol (MCP), this agentic payment solution supports embedded payment flows through dialogue-based interactions with AI agents, covering both confirmed purchase requests and conditional, pre-authorized transactions, such as purchases within a predefined spending limit or scheduled flash sales.

It is noted that the Antom agentic payment solution is now open-sourced on GitHub.

Antom can also connect AI agents to diverse APMs, including a wide range of digital wallets.

With Antom EasySafePay, the industry’s first streamlined checkout solution for APMs, the payment process is faster and simpler.

Antom EasySafePay allows users to link their digital wallets directly to the checkout page without being redirected to external apps, fitting naturally into agent-initiated payment flows.

Antom EasySafePay combines convenience with robust safeguards.

It leverages Multi-Party Computation (MPC)-based AI risk management and mobile device security systems to identify and block fraudulent transactions, preventing phishing, fraud, and identity misuse, reducing the risk of account takeovers for digital wallet users while protecting privacy.

Antom is also setting a new industry framework for agentic payment security.

Compliant with the rules of PCI Security Standards Council (PCI SSC), it manages payment assets through cryptographic measures and builds an AI-ready user intent analysis and authorization model for each transaction.

This model links key transaction parameters with intent evidence to create verifiable credentials, enabling end-to-end traceability.

Thus, users can maintain control and visibility into how agents act, and disputes can be resolved through privacy-computing-based credential queries.

Antom’s structured and adaptable solution is also designed to help AI agents support diverse payment methods such as cards, wallets, and bank transfers, reaching a broad customer base efficiently while reducing integration costs.

This launch reflects Ant International’s AI strategy by combining its deep know-how in the fintech sector, trusted AI capabilities and platform-level AI support, said the statement.

The goal is to support developers, financial institutions, and merchants to confidently embrace AI-driven commerce.

“Agentic payment is a foundational step in allowing AI agents to generate real value in our everyday life,” said Gary Liu, General Manager of Antom, Ant International.

“The rise of agentic payment calls for rethinking how payment systems are designed,

“We look forward to co-building the protocols and frameworks with partners across the financial, tech and commerce sectors to ensure agentic payments are smooth and reliable,” he added.

#AICommerce #AgenticPayments #DigitalWallets #FintechInnovation #SecureTransactions

- AICommerce

- AgenticPayments

- DigitalWallets

- FintechInnovation

- SecureTransactions

- If

- Ifvex

- Ifvex_AI

- Ifvex_Social_Network

- Ifvex_AI_Community

- Ifvex_Technology

- Artificial_Intelligence

- AI_Social_Network

- AI_Community

- AI_Networking

- AI_Collaboration

- AI_Innovation

- AI_Technology

- AI_Trends

- AI_Development

- AI_Tools

- AI_Platforms

- AI_Solutions

- AI_Integration

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness